NEW CONSTRUCTION LENDING

Flexible FInancing For Construction Projects

PRODUCT OVERVIEW

- Loan amounts up to $10 million for spot projects

- Loan amounts up to $50 million for multi-unit developments

- Available for residential purposes, may contain commercial and mixed-use 20% or less, restrictions apply

- Terms up to 24 months

- Acceptable loan purposes: purchase, refi

- Construction teams in place to manage and complete property construction or rehabilitation

- Liquidity equal to 7% of contingent liabilities

- Lender’s Wholesale to always remain in first-lien position; 2nd lien allowed if seller carry or equity partner with Intercreditor or Subordination agreement

- No Rural; must be within 25 miles of MSA with a population of greater than 50,000

PROPERTY TYPES

- Single Family

- Condo

- Townhouses

- 1-4 units

- Multi-Family

Budget

- Budget Holdback >$1M, 3rd party review required

- Interest Reserves – 100% of Initial Advance PLUS 50% of Holdback

- Construction draws based on inspection report and/or reciepts (We allow receipts for soft costs)

- Interest is calculated on drawn balance

LTV(FV)

- 65% – 70% depending on LTC and property type

LTC

- 82.5% or less - SFR, 1-4 Units ONLY - 70% LTV(FV)

- 82.6% to 85% - SFR, 1-4 Units ONLY - 65% LTV(FV)

- 85% or less - 5+ Units - 65%

CONTINGENCY REQUIREMENTS

- 30+ Doors: 10%

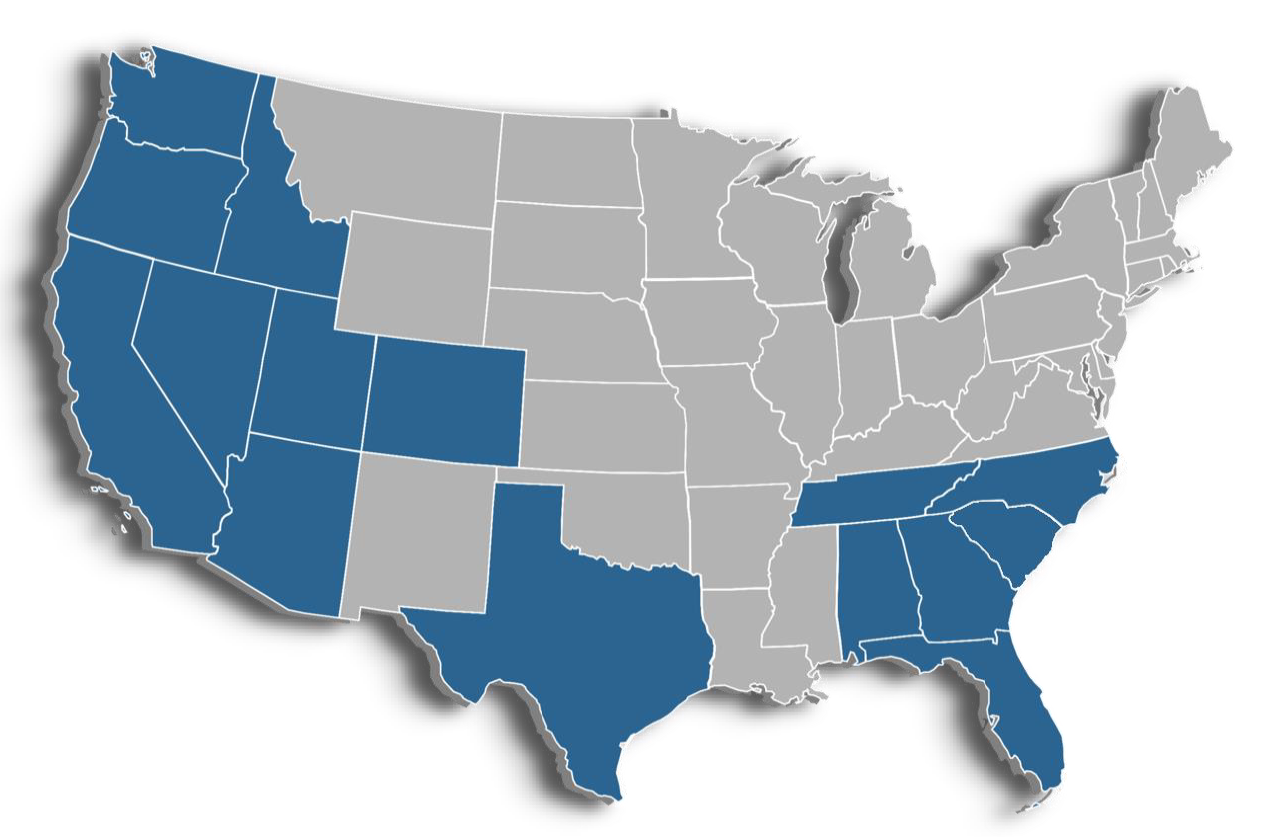

LICENSED LENDING STATES

AL, AZ, CA, CO, FL, GA, ID, OR, NC, SC, NV, TN, TX, UT, WA

EXCLUDED DWELLING/LOAN TYPES

- No Lot Loans

- No Mobile or Log Homes

- No Co-Ops

- No 60+ Delinquent

- No Land Loans

- No Leasehold