Fix-and-Flip And Construction-Completion Loans

Flexible Financing For Rehab or Existing Projects

FIX AND FLIP/CONSTRUCTION COMPLETION OVERVIEW

- Term up to 24 months

- Acceptable purposes are purchase, refinance, cash-out refinance considered for current borrowers

- Loan limits are 100K - $10M (total loan amount/cash to close will vary by deal)

- No rural; must be within 25 miles of MSA with a population of great than 50,000 (unless internal refi, then Pre-Sell is required

PROPERTY TYPES

- Single Family

- Condo

- Townhouses

- 1-4 units

- Multi-Family

BUDGET

- Budget Holdback >$1M, 3rd party review required

- Interest Reserves – 100% of Initial Advance PLUS 50% of Holdback

CONTINGENCY REQUIREMENTS

- 30+ Doors: 10%

EXCLUDED DWELLING/LOAN TYPES

No lot loans. No Mobile or Log Homes. No Co-Ops. No Leasehold. No 60+ Delinquent Loans. No Revocable Trust.

LTC/LTV PURCHASE

- LTV Purchase: Lower of 80% of As-Is value OR 80% of Purchase Price

- Finished LTV (FV) Purchase : 70% of Finished Value

- LTC Purchase : 90% of Total Cost

LTC/LTV REFINANCE

- LTV Refinance: 80% of As-Is value

- Finished LTV (FV) Refinance : 70% of Finished Value

- LTC Refinance: 85% of Total Cost

GENERAL REQUIREMENTS

- All lending for investment purposes only

- Permits in hand

- Lender’s Wholesale to always remain in 1st Lien position

- Construction draws based on inspection report and/or reciepts (We allow receipts for soft costs)

- Interest is calculated on drawn balance

- Contact Loan Officer for documentation requirements

- Minimum of 30+ Doors

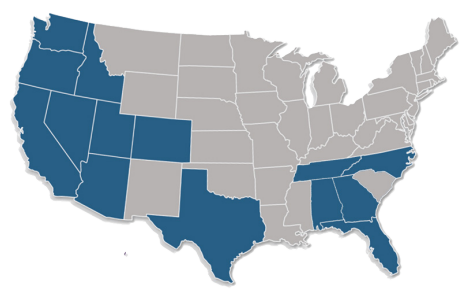

LICENSED LENDING STATES

AL, AZ, CA, CO, FL, GA, ID, OR, NC, NV, TN, TX, UT, WA